What would you say is the number 1 reason that people don’t achieve their financial goals? What do you think the greatest single threat to financial un-breakability is?

- It isn’t lack of information.

- It isn’t lack of motivation.

- It isn’t lack ability.

- It isn’t lack of resources.

- It isn’t the plethora of bad advice out there.

Or the easy access to credit, the bubbles, or the three paradigm shifts.

The biggest reason people struggle to reach their goals, financial or otherwise, is that we all suffer from cognitive bias.

Which ones, how, and when vary but most of our challenges come down to our brains incorrectly processing information as they do what they are designed to do – simplify and reduce information to what is immediate and relevant for survival and reproduction.

Whenever I meet a client for the first time, I show them an optical illusion. I show them two circles of identical sizes and ask them which one looks bigger. And then they pick the one that looks larger. I then show them they are both the same size. This however isn’t the point.

After showing them the two circles are the same size, I ask them to look at me for a moment and just chat for 30 seconds or a minute. Then I ask them to look at the circles again and ask them which one looks bigger to them. And it is always the same one. You see, even when you know something is 100% true, your brain can still tell you it’s wrong. This is where an exceptional advisor differs from a merely good one. A good advisor will explain the facts to you and layout your choices. An exceptional advisor will explain the facts to you and either insure you’re interpreting them accurately or, when you are unable to do so, tell you that your objectivity is severely compromised. So, what are some of these cognitive quirks that can cause such fiscal pain? Read on and find out.

What is a Cognitive Bias?

A cognitive bias is a fault in reasoning which occurs when a person bases a decision on their pre-conceived ideas or beliefs, rather than using objective facts. In behavioral finance theory, cognitive bias plays a great role.

There are several kinds of cognitive biases. These are Overconfidence bias, Self-serving bias, Herd mentality, Loss aversion, Framing cognitive bias, Narrative fallacy, Anchoring bias, Confirmation bias, Hindsight bias, and so on.

Some of these cognitive biases are described below:

FOMO: Fear of Missing Out

In light of the recently “crazy” and volatile markets, it seems putting this first is a good idea. We read in the paper about how someone has made a stupid amount of money on bitcoin. Game Stop shares, despite the underlying asset being worthless went on a wild rider with some making a lot of money and many more getting hurt. Everyone knows someone who is making a “very nice living” day trading a couple of hours a day. Are you a sucker for putting your head down and working? Am I a sucker for missing all the opportunities? And then we dive into something (or things) that are needlessly risky and not part of our plan.

Herd mentality

Herd mentality (also known as mob mentality) occurs when people act in the same way as “the crowd” often in ways completely contradictory to the ways they would act on their own. They tend to get swept up in the emotions of an event and cease to be able to analyze things effectively. The recent Game Stop short squeeze driven by social media is a good example of how it can affect investors and markets.

Loss aversion

Loss aversion is a cognitive bias in which the loss is disproportionately high to the hope for a similar gain. Loss aversion bias has a tendency to increase and multiply the more times somebody experiences a loss, making it potentially debilitating and exposing investors to a disproportionately high inflation risk.

Overconfidence bias

Overconfidence occurs when a person has an inflated belief in their own abilities. They believe they have superior knowledge, and won’t listen to or give credence to recommendations from others. It usually goes hand in hand with self-serving bias.

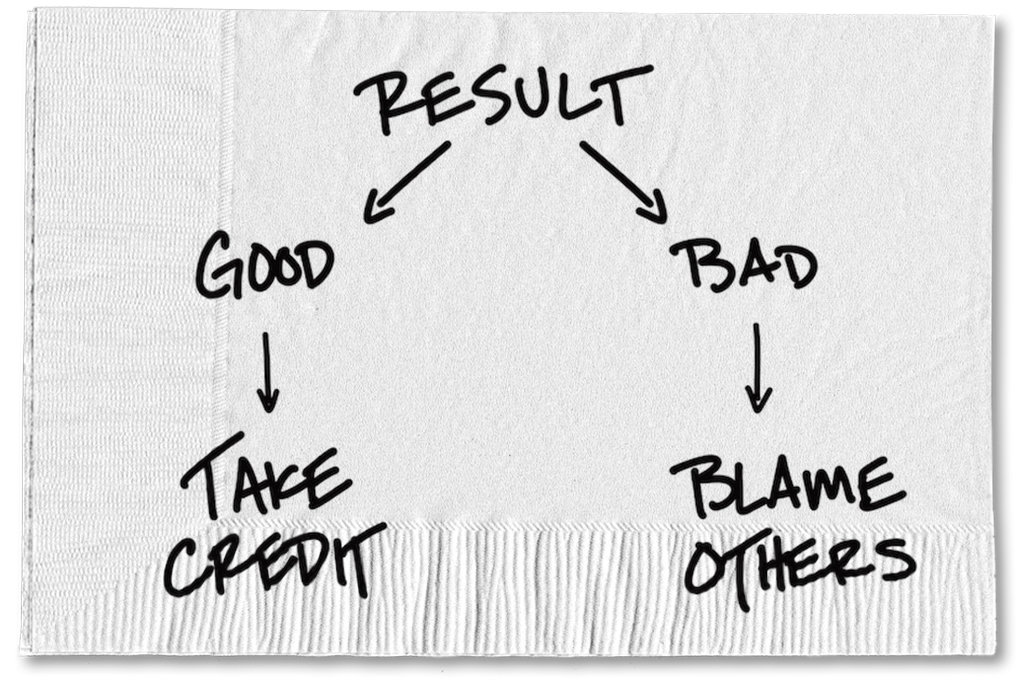

Self-serving bias

Self-serving bias is when we attribute our successes to our actions and our failures to external factors such as bad luck. When we win it’s because of skill and hard work, when we lose it’s because of random circumstance and a cruel universe.

Hindsight bias

Hindsight bias is commonly known as “knew-it-all-along” bias. We overvalue our capability to predict outcomes. Vastly. Frequently. Studies have consistently proven it.

Availability bias

This bias is also known as availability heuristic. It refers to our affinity for using information that we can remember rapidly in assessing any idea or topic. We consider the most easily accessible information, which is the most recent information, to be correct while disregarding alternative opinions and solutions. Basically, availability bias is a reflection of the fact that we put more emphasis and stock on recent events than those from further in the past.

Optimism bias

Optimism bias is when we believe bad or negative things are less likely to happen to us than other people. “One in three people will be unable to work for 3 months or more but that won’t happen to me.”

Status quo bias

Status quo bias occurs when a person does not like change and tends to stick to decisions even when the transition costs may be minimal and the impact significant.

Anchoring bias

Anchoring bias is the tendency we have to over rely on the first information we receive. A common example of this is when a high price is set for a used car and that sets the standard for the entire negotiation so a lower price seems reasonable even if it’s higher than the market value.

Confirmation bias

Confirmation bias occurs when we tend to notice and retain evidence that supports our preexisting views. This is illustrated in the following paragraph from the book The Psychology of Money: Timeless lessons on wealth, greed, and happiness –

” ‘If you grew up when inflation was high , you invested less of your money in bonds later in life compared to those who grew up when inflation was low . If you happened to grow up when the stock market was strong , you invested more of your money in stocks later in life compared to those who grew up when stocks were weak . The economists wrote : “ Our findings suggest that individual investors ’ willingness to bear risk depends on personal history.’ ”

Framing cognitive bias

Framing cognitive bias occurs when a person makes decisions based on the way the information was presented, by whom it was presented, or how attractive it looked. They ignore the actual, verifiable reality.

To one degree or another all of the above can influence our decisions – and while awareness of them is helpful even knowledge of them doesn’t render them inert. Just like we can’t see an optical illusion differently because we know it exists we can’t always look past our own cognitive biases even if we know they are there.